Public Equity Crowdfunding in Malaysia: The Pros & Cons

- Reshvinjeet Singh

- Aug 3, 2023

- 7 min read

Updated: Oct 19, 2023

Public equity crowdfunding is a relatively new way for businesses to raise capital without having to go through traditional channels, such as venture capital or bank loans. It allows businesses to sell shares of their company to the public in exchange for investment.

The Securities Commission Malaysia (SC) regulates public equity crowdfunding in Malaysia. The SC has set a number of requirements that businesses must meet in order to raise capital through public equity crowdfunding. These requirements include having a sound business plan, being able to demonstrate that there is demand for their products or services, and having a track record of success.

In Malaysia, there are a number of platforms that allow businesses to raise capital through public equity crowdfunding. However, it is important to weigh the risks and benefits carefully before deciding whether or not to pursue this type of fundraising.

Pros of Public Equity Crowdfunding

Here are some of the advantages of public equity crowdfunding in Malaysia:

Increased Visibility and Gauge Market Sentiment

By applying for public crowdfunding, it allows a company to increase the visibility of a business and its products/service, while being able to gauge the reaction of the general public or market reaction. This may lead to increased sales and growth while also providing valuable data for the next course of action of your company.

Convenience

Crowdfunding campaigns can be set up whenever and wherever, considering that there are multiple crowdfunding platforms available within Malaysia that provides immediate access to a fast-growing community that is eager to back new ventures.

Great Alternative to Banks

Public equity crowdfunding platforms allow businesses to reach a large pool of potential investors, including retail investors, accredited investors, and institutions. This can help businesses to raise more capital and at a faster rate than they would be able to through traditional methods, i.e., bank loans and/or venture capital firms. The conditions to raise capital through public equity crowdfunding may also be less strict when compared to applying for a business loan, such as upfront fees and interest rates.

Control Over Decisions

Businesses that raise capital through public equity crowdfunding typically do not have to give up as much control over the business as they would if they raised capital from venture capitalists or angel investors. This is because public equity investors typically do not have as much say in how the business is run.

Momentum Build-up

As crowdfunding campaigns often go viral and attracts attention in social media, a business that seeks for public equity crowdfunding may receive publicity resulting from all the buzz that was building up since the launch of the campaign.

Access to New Networks

Through public equity crowdfunding campaigns, business relationships with potential customers and investment partners through the engagement with people who are interested in the business may be beneficial in the future. Awareness on the business may open doors to new relationships such as partnerships, sponsorships, co-branding and ambassador marketing, as the public will be looking to track the progress of the business and promote the brand through their networks.

Reduced Financial Risks

Public equity crowdfunding has relatively lower financial risk because investors only commit funds if the campaign is successful. This means that if the campaign fails to reach its target, investors do not lose any money while the business raising capital are free to try again or venture out for new methods of raising capital. Additionally, the funding progress of a campaign can help gauge market interest, which can give investors an idea of whether or not the business is likely to be successful.

Investor Tax Incentive

Individuals who invest in equity crowdfunding are eligible for tax exemption on aggregate income equivalent to 50% of the amount invested. This tax incentive expires on 31 December 2023.

[UPDATE: In the Budget 2024 speech, the Malaysian Government has proposed to extend this tax incentive for an additional period of 3 years.]

Cons of Public Equity Crowdfunding

Here are some of the potential disadvantages of public equity crowdfunding that investors should consider before investing.

Inflexible Terms and Conditions

Public equity crowdfunding is inflexible, as it does not allow for alterations to campaigns after they have been launched. This means that businesses cannot change the details of their campaign such as description, terms and conditions, and allotted completion time, once it has been launched. This can be a problem if the business needs to make changes to its plans or if there is a change in the market.

Administration and Accounting

There may be high fees and expensive upfront costs to set up crowdfunding campaigns and these fees can be a significant financial burden for businesses, especially those that are just starting out. Some crowdfunding websites may have strict rules regarding how campaigns are run and limit the kind of information businesses may include in your campaign. This can make it difficult for businesses to promote their campaigns and reach potential investors. Additionally, businesses that raise capital through public equity crowdfunding need to be able to accurately track investors, contributions, and the number of shareholders. This can be a challenge, as there are a number of different ways to track this information.

Idea Theft

Public equity crowdfunding can be a risk for idea theft, as businesses that raise capital through this method are essentially sharing their business ideas with the public. If these ideas are not protected with copyright or patent, they may be stolen by competitors. This is especially a risk for non-consumer projects, as these projects are often more difficult to interpret and their value is unclear.

Difficult for Non-Consumer Projects

Public equity crowdfunding can be difficult for non-consumer projects, as investors are typically more interested in investing in businesses that have a clear, tangible impact on consumers. Services and other forms of non-consumer ventures are more difficult to interpret and their value is unclear, which can make it more difficult to raise capital through public equity crowdfunding.

Crowdfunding campaigns are largely successful in the B2C (business-to-consumer) marketplace because investors can immediately identify with the product or service that is being offered. They can see how the product or service will benefit them personally, and they are more likely to invest in businesses that they believe in.

On the other hand, services and other forms of non-consumer ventures are more difficult to interpret and their value is unclear. This can make it more difficult for investors to understand the business model and the potential for return on investment.

Non-Guaranteed Success

There is no guarantee that a campaign will reach its funding target during public crowdfunding. In the event that a campaign does not reach its target, any finances that have been pledged are usually returned to investors, and the efforts and resources that were invested into the campaign will be futile. Additionally, public equity crowdfunding may not be the most suitable option for businesses that are seeking to raise more than RM 5 million, as there are limits on the amount of capital that can be raised through this method. Additionally, in order to incentivise the public funders to pledge/invest to your campaign, rewards are required to be offered. However, depending on the rewards offered, rewards may not be appealing enough to incentivise the public funders to invest a significant amount.

Equity to be Offered

When businesses raise capital through public equity crowdfunding, they are essentially selling shares of the business to the public. The amount of control that investors have will depend on the percentage of the business that is offered as equity. For example, if a business offers 10% of its equity through public equity crowdfunding, then investors will own 10% of the company and will have a say in how it is run. Investors who contribute to a public equity crowdfunding campaign are typically looking for a return on their investment. This means that they may want to have a say in how the business is run, as they want to make sure that their investment is being used wisely. Additionally, investors may expect to see a return on their investment in the form of dividends or capital gains.

Lifetime Public Crowdfunding Threshold

Businesses cannot raise more than RM 20 million through public equity crowdfunding in their lifetime. This is the maximum amount of money that a business can raise through public equity crowdfunding in its lifetime. The threshold is set by SC to protect investors and to ensure that businesses do not raise too much money through this type of fundraising. Additionally, there are typically fees associated with with setting up and running a public equity crowdfunding campaign, which can be up to approximately 5% of the funding raised.

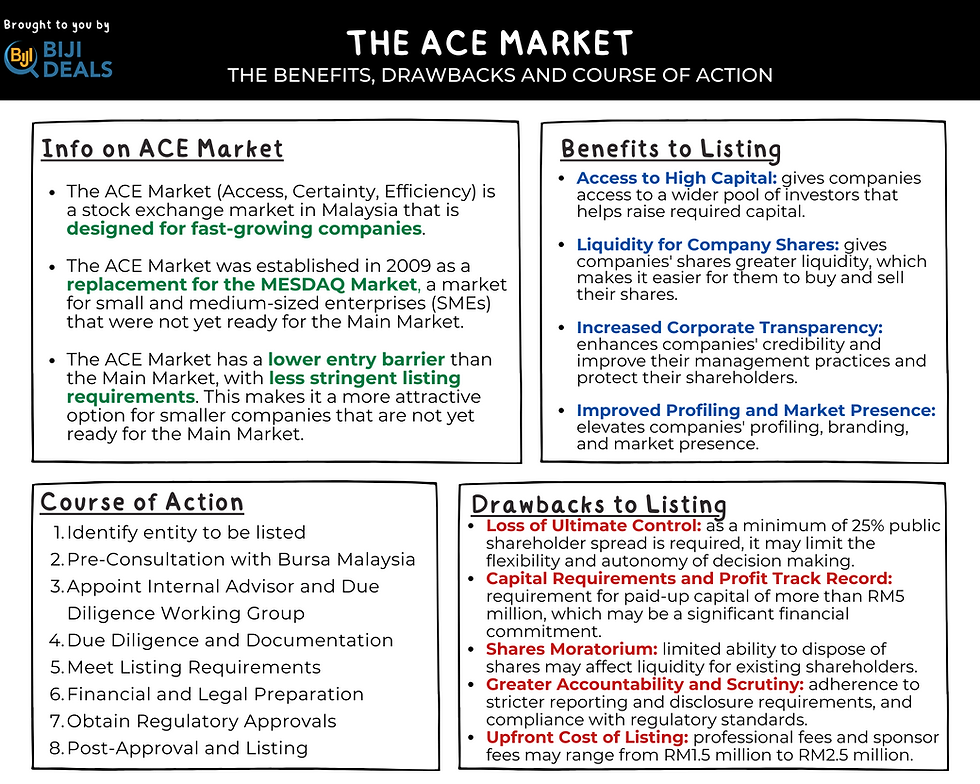

TL;DR? Here is a bite-size overview of the article for you.

Conclusion

Public equity crowdfunding can be a valuable tool for businesses that are looking to raise capital. However, it is important to weigh the advantages and disadvantages before launching a campaign. Businesses should carefully consider their needs and goals, as well as the regulatory requirements, before deciding whether or not to use public equity crowdfunding.

In addition to the advantages and disadvantages listed above, there are a few other factors that businesses should consider before launching a public equity crowdfunding campaign. These include:

The type of business: Public equity crowdfunding is generally more suitable for businesses that have a clear product or service and a strong team in place. Businesses that are still in the early stages of development may not be as successful with public equity crowdfunding.

The target market: Businesses should carefully consider their target market when launching a public equity crowdfunding campaign. The campaign should be targeted to investors who are likely to be interested in the business's products or services.

The marketing plan: Businesses should have a clear marketing plan in place before launching a public equity crowdfunding campaign. The plan should outline how the business will reach its target market and generate interest in the campaign.

Overall, public equity crowdfunding can be a valuable tool for businesses that are looking to raise capital. However, it is important to weigh the advantages and disadvantages before launching a campaign. Businesses should carefully consider their needs and goals, as well as the regulatory requirements, before deciding whether or not to use public equity crowdfunding.

Comments